Financial Inclusion via Digitisation in India

#Indiastack #AadharStack #finance #InnovationForEveryone

A digital infrastructure known as the India Stack is revolutionising access to finance for everyone in the country.

Innovation in digital finance means that millions of people in the formal and the informal economy can now accept payments, settle business transactions, and do funds transfers across the country with just a few clicks on their smartphones! 📲

Pandemic accelerated the use of digital payments for small transactions as people try to avoid offline interactions. This tech built called India Stack — a comprehensive digital identity, payment, and data-management system developed exclusively by Indian Gov is a game-changer. The India Stack is empowering access to financial services in an economy where retail transactions were mostly heavily cash-based. A digital ID card significantly lowers the cost of confirming the identity of the user with pinpoint accuracy! #aadharcard

India Stack is based upon open-access software standards which are enabling payments between banks, fintech firms, and digital wallets. The user is empowered by giving final consent before the personal data is actually shared with any entity. Expansion of digital payments facilitated by India stack has been an important driver of economic development in India and has helped support incomes in rural areas and boost sales for firms in the informal sector during the #pandemic !

Layer 1: Digital identification

The first step in the creation of the India stack began in 2010 with the launch of a #biometric digital ID system called #Aadhaar — Hindi for “base or foundation.”

The government initiated a campaign encouraging people to have their photographs, fingerprints, and other biometric details taken at enrollment centres across the country at an unprecedented pace. Overall, 1.29 Billion have been registered so far in this initiative !

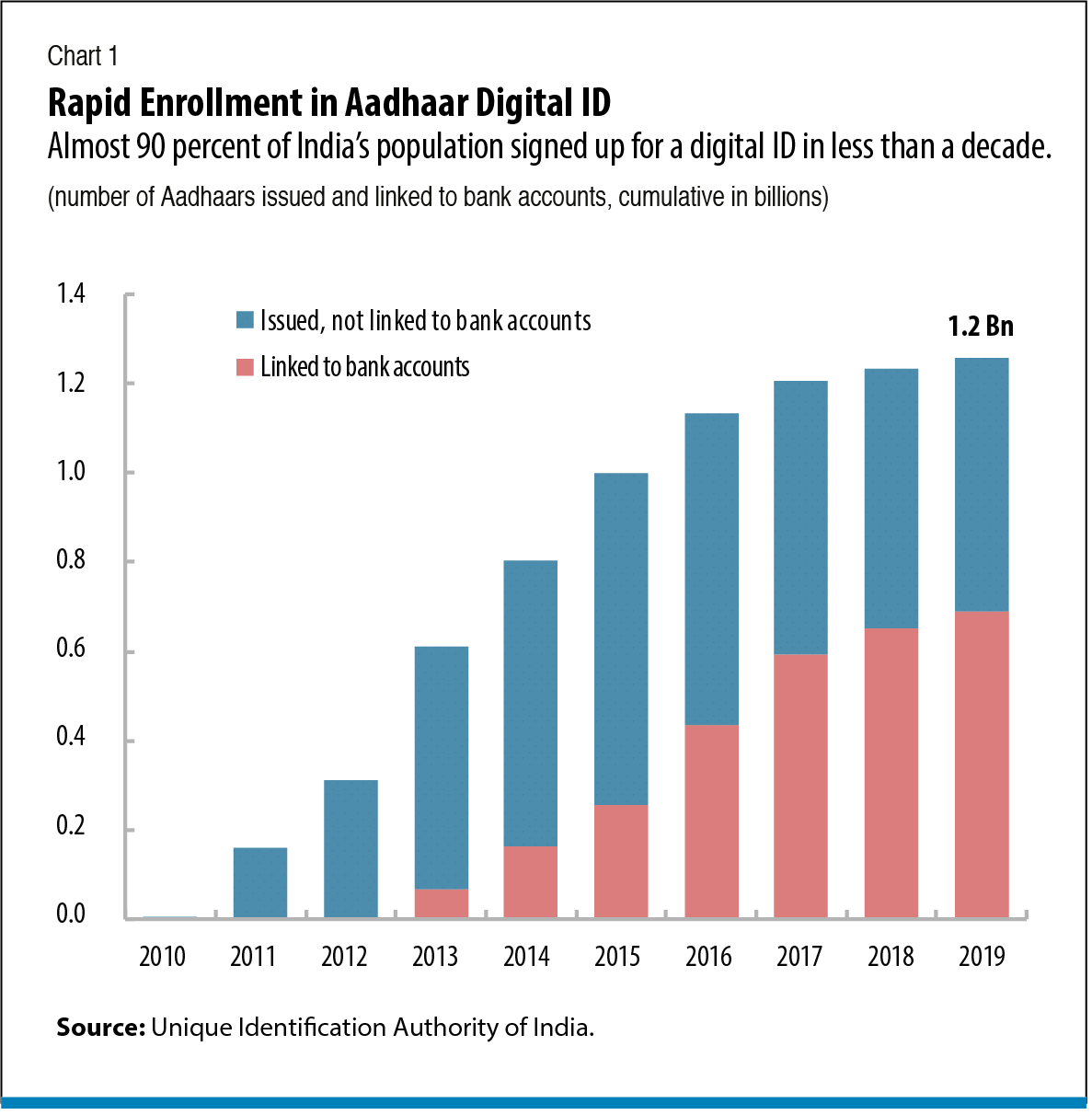

In the registration process, each person receives a unique 12-digit identification number that can be used to access a range of services. Remarkably, 1.2 billion people — almost 90 per cent of India’s population — signed up for a digital ID in less than a decade a record for the world!

An interesting chart for visual understanding: Success of this initiative lies in the fact that people and institutions all came together to make this a roaring #success

Before #Aadhaar, a broken record-keeping system resulted in nearly half the population lacking a nationally accepted ID card. Driver’s licenses, voter ID cards, and the like could provide authentication for a patchwork of services but weren’t themselves connected to each other.

However, the complexity of verifying identity at a central level made it costly (both at the unit level and consequences arising out of confirming fraud identity) to deliver banking and other financial services. After all, who would give credit to anyone whose identity was unknown?

India’s central bank RBI identified the potential for #Aadhaar to transform #banking and its financial inclusion initiative found a new mantra. It built a digital process so that commercial banks could verify a new customer’s identity instantly through the Aadhaar database. Government benefits could now be paid directly into these verified identity accounts, and people could access their funds conveniently through debit cards or smartphones.

This phenomenon represents an impressive fast-forward of traditional financial development setting a benchmark for other countries and their banking systems across the world! Our financial inclusion based on digitisation has certainly been the fastest!

To compare it with our past records — A decade earlier, just one in three adults in India had a bank account. *Similar expansions in financial access elsewhere have taken almost half a century* But we needed more to make the impact more profound — comes the Layer 2

Layer 2: Interoperable payments

Gov introduced a new layer to the retail payment system, known as the Unified Payments Interface (#UPI) so that banks can now exchange messages and payment orders with nonbank firms (NBFCs), merchants. The Second layer of India Stack.

With this new layer incorporated in place, street vendors and small traders could confirm payments receipts for goods or services through a digital wallet on their smartphones. They could transfer funds instantly to someone else — a struggling relative in a remote village as well!

In many other countries including the first world nations and developing nations, transfers like this still take days or even weeks and would likely involve depositing cash at a distant bank branch and paying hefty transfer fees. We certainly have moved fast!

Financial transactions are enabled by payments rails — the digital roads to progress and are no doubt providing an accelerating framework for our country to progress in a fast forward manner, a much-needed initiative to help people prosper!

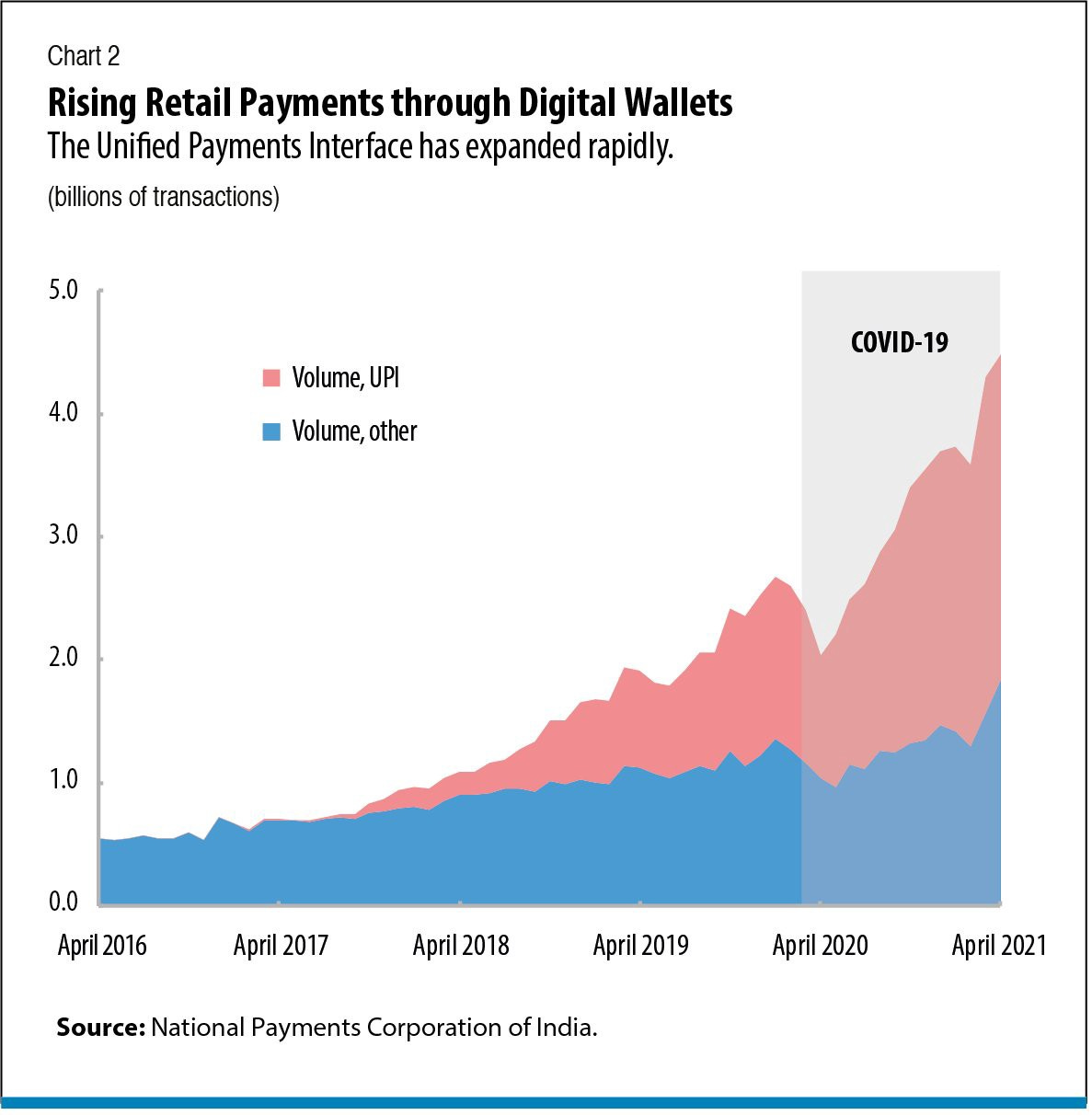

The graph speaks for itself :)

Layer 3: User Consent

#Trust through consent #Data has proven today itself as a key pillar of the digital economy of any nation. Access to, and control over, it now determines an economy’s future in terms of #growth, #equity, and #stability overall. This was a needed step!

A third layer of the #indiastack allows for identification and verification of digital documents that will replace traditional paper equivalents thereby, increasing the efficiency and integrity of the system as a whole. It allows for a user’s identity to be confirmed across channels.

Layer 4: Account Aggregators

Layer 4 of the #IndiaStack (which was recently in the news for its formal launch) consists of account aggregators (as called) that enable the flow of financial data between individuals and financial firms based on user consent (paramount). This channelisation of information flow has been currently kept encrypted which means that the same information cannot be read, used by account aggregators themselves.

A sustainable financial incentive for these AAs is yet to be figured out however, it’s a major step in the right direction. This entire approach is going to empower access to credit for millions of people who could never prove their own identity to credit institutions earlier.

This approach towards data democratisation is a bit different from what is happening in other countries for eg., UK.

In other countries, AAs typically offer services in exchange for access to data, which they can then use to cross-sell other financial services providing an incentive to sustain the business activity.

In the #IndiaStack they are constrained from doing this activity and how this will emerge in long term is yet to be seen. In order for this to be successful, AAs either should be provided with a way to monetise or else the cost of acquiring data may not match the earnings possible.

AAs can offer the trust that adds synergies to the various layers of India Stack. They can authenticate individuals’ identity, based on their digital ID, collect data from multiple sources and unilaterally provide the same data to other inst. (for eg, a bank or NBFC) via APIs.

This entire framework of data sharing will definitely provide a powerful foundation for establishing trust in the digital economy between multiple orgs and enable people to leverage their data for their own betterment further alleviating their livelihood financially.

Some lessons from here:

Interoperability matters — something of which we are seeing in the emerging #crypto space as well

2. Primary Identity matters — Individuals who can prove their identity and actions can empower themselves in this age of digital progress

3. Open Architecture matters — A recent initiative of #Indiastack called OCEN is working aggressively leveraging Layer 4 (AAs) to enable revenue-based financing for SMEs by verifying their GST returns digitally.

This will open up opportunities for millions of SMEs in India who were till now dependent on unsustainable interest rates to grow their business. A true financial renaissance for Indians is coming empowered by our truly #IndiaStack More on this later.. :)